SME money which have possessions supported as guarantee is additionally certainly the cheapest kinds of capital when you look at the Singapore

Increased exchangeability and money flow

Property possession you may work with people from the functioning given that guarantee loan collateral, which then lets them to get a lot more working capital finance when the there was sufficient financing-to-valuation buffer.

Which additional cashflow are often used to target some team demands such expanding personnel amount, updating gadgets, or committing to active tech.

More control more than property utilize

While leasing deliver people a lot more flexibility and lower CAPEX, SMEs will get by themselves having to deal with rigid laws place because of the its landlords while using rented industrial rooms. Incorporate limits will be enforced to possess home improvements, changing electric businesses, or limitations toward list sites.

Tax coupons

Enterprises which have possessed industrial otherwise commercial attributes can also enjoy taxation discounts. Mortgage desire paid down are tax deductible expenses and you will property depreciation you can expect to qualify for financing allowances states .

People out of low-homes pay out to a max away from step 3% stamp obligation , while this increases in order to a max regarding cuatro% to own qualities. After that, rather than qualities, there is no most customer’s stamp duty enforced having sales regarding the second otherwise then low-land.

Do mention commercial/industrial characteristics will be sold having GST if for example the supplier try a great GST joined entity. You could potentially allege the fresh new GST part back following the purchase are completed if you find yourself to purchase around a GST entered organization.

Commercial Features – Commercial features are mainly facility and you can warehouse places (not as much as B1 class), heavy globe warehouse rooms zoned B2, and you may commercial parks.

There are also other market non-qualities subsets such as for instance scientific suites, HDB shophouses which have home-based portion and you may maintenance shophouses.

There are particular specific niche subset away from property sizes one to certain banking companies are not able to money, such as JTC attributes.

Capital carrying providers

To minimize threat of assets being exposed to liquidation throughout the event of adverse commercial litigations, some entrepreneurs might choose to make use of an investment holding providers to buy and secure the assets.

Finance companies will perhaps not fund the configurations holding businesses with no working ideas. To help you decrease it, new operating parent team you will definitely bring corporate make certain on the financial because the assistance.

The new received possessions you’ll then getting parked not as much as a hanging team one will act as a sheet from protection from unforeseen liquidation occurrences. So it arrangement was at the mercy of respective banks’ borrowing principles.

In case the credit entity was an absolute investment holding organization that have no energetic company operations, banking institutions are required to incorporate TDSR (total obligations maintenance proportion) computations to your individual investors of your own funding holding team.

In case the personal stockholder of holding team already has actually hefty individual obligations otherwise belongings loan getting serviced, there could be procedure passage TDSR calculations.

This should be factored into account whenever choosing whether to keep the home below an investment carrying company otherwise functional organization.

Refinancing

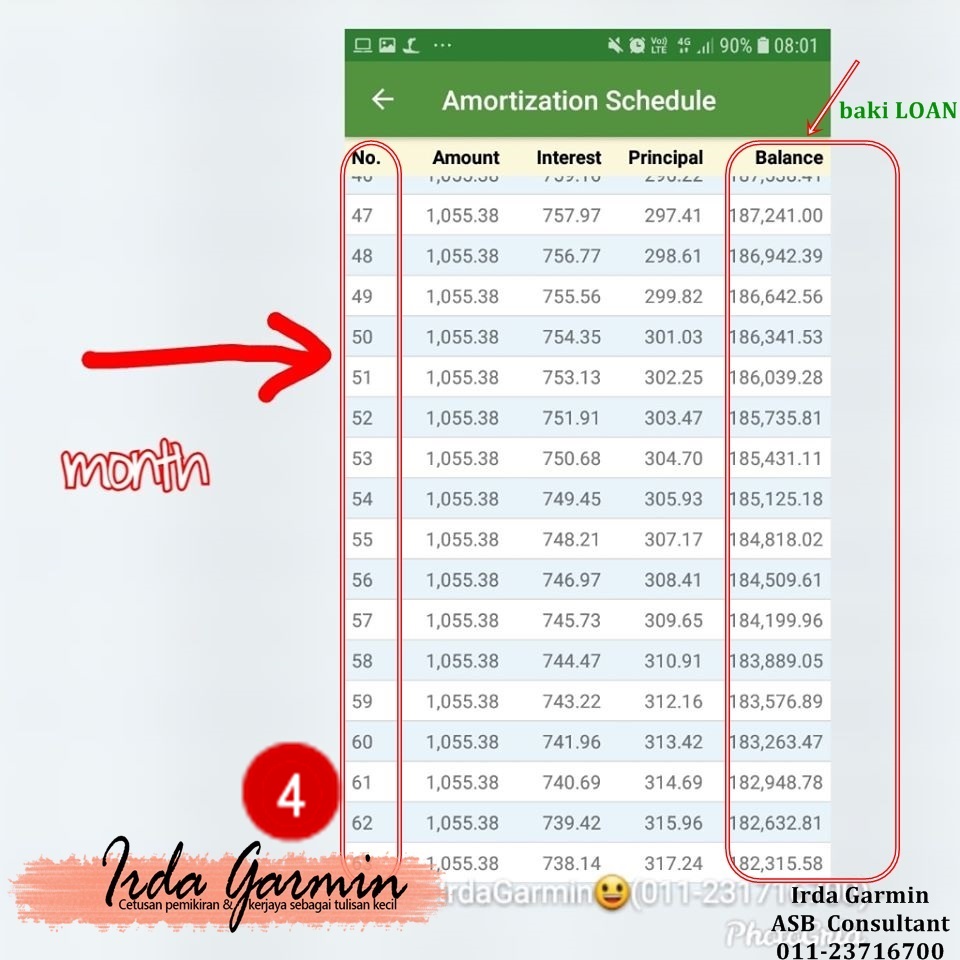

Most industrial/commercial team property money has actually a great lock-for the age of step 1 to 3 ages. Following protected period is over, rates commonly typically become increased significantly.

SMEs having established assets fund that will be regarding lock-inside months you are going to consider first requesting a beneficial repricing software using their most recent financial so you can a package with lower rates. This helps you save troubles and legal conveyancing charges to re-finance this https://www.clickcashadvance.com/installment-loans-oh/ottawa/ new loan to another lender.

If you think that the repricing rate your existing bank also provides is still greater than economy pricing, is refinancing the loan to a different lender to save to your interest costs.

Target to endure this action three or four days ahead of your own loan’s secure-when you look at the several months is due. Courtroom conveyancing processes legally corporation to help you re-finance property loan to help you a different lender typically takes anywhere between two to three weeks.

Charles Mike, a distinguished EV charger expert and author, has over 20 years of experience in electric vehicle charging technology.

Born and raised in Texas, he studied electrical engineering at the University of Texas, where his fascination with EVs began.

His research focuses on improving the efficiency and sustainability of EV chargers, often integrating renewable energy sources. Living in Texas, he continues to advocate for innovative, eco-friendly charging solutions that support sustainable transportation.