The benefits and you will drawbacks out of boosting your charge card maximum (and how to take action)

Discuss new table out-of content material

- What are the benefits of increasing your bank card maximum?

- What are the drawbacks regarding boosting your bank card maximum?

- Therefore, how will you ensure you get your charge card limit enhanced?

- And you will, what happens if my personal mastercard restrict boost request is actually denied?

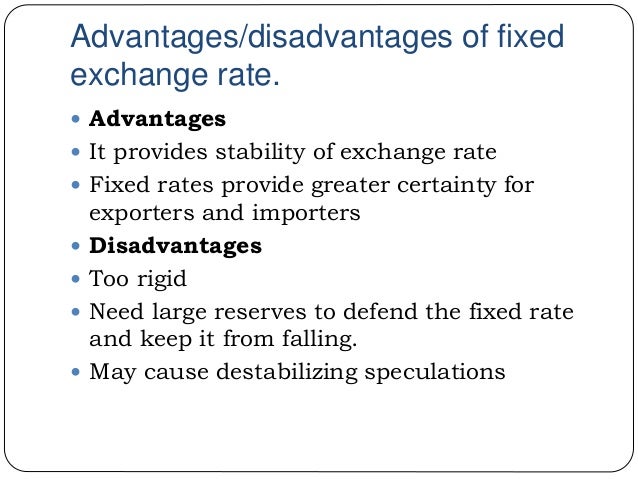

- Increased mastercard restrict helps you loans a big purchase and other tips you need or provide an economic coverage net if you have surprise bills.

- If you’re a higher credit limit has many advantages, in addition it produces the potential to adopt a lot more debt, which can adversely affect your credit rating when you are incapable to deal with that personal debt efficiently or make costs punctually.

- For many who have indicated a history of punctually costs particularly guaranteeing you make about your own lowest payment per month timely because of the deadline, their bank card vendor you’ll pre-accept you to own a top borrowing limit.

- When a loan provider stretches additional borrowing due to a beneficial pre-acceptance, there is certainly usually zero tough credit score assessment.

The huge benefits and you can disadvantages away from boosting your mastercard limit (and the ways to get it done)

Perhaps you will be nevertheless strengthening your own borrowing personal loans in Utah for bad credit from the bank but your latest charge card limit is lower than you would like. Or maybe you’ve got a massive buy planned and want alot more offered credit. Regardless of the reason, you may like to believe in the event that a credit limit increase is acceptable to you personally.

Simply there’s a single disease – you never can increase your mastercard limit otherwise if it is even the great thing to suit your credit history or to assist you to control your loans.

You are in luck! Our company is about to take you step-by-step through the fresh new procedures to take on using to have a borrowing limit raise, including some of the positives and negatives of going one to, thus you have the content you need to pick what’s right for your requirements.

Naturally, the fresh new Zero. step 1 advantageous asset of increasing your mastercard limit would be the fact your own credit limit expands so you have a lot more borrowing for many who are interested (and you may end supposed overlimit in certain facts).

One of many secret reasons why you should improve your bank card restrict is to improve to purchase electricity. A high borrowing limit helps you if you would like generate an urgent big pick and wouldn’t be able to set almost everything in your cards with your newest borrowing limit. Furthermore ideal for people that are still strengthening the borrowing and would like to continue steadily to enhance their credit limit to exhibit the ability to spend and you will create debt, otherwise those people who are rebuilding the borrowing. In those times, of many credit card issuers thing reduced borrowing from the bank limitations to start otherwise playing cards that are secure by other possessions (eg a deposit). You could possibly raise one restriction after you improve your credit rating or appearing you can make the monthly premiums to the big date.

One to less popular (but essential) cause of increasing your charge card limit is that it can help to improve your credit score. (Yes, you see that right.) Among metrics you to definitely goes into figuring your credit score will be your borrowing from the bank application ratio, which is calculated from the isolating the total amount of borrowing from the bank you are having fun with (the balances you really have) by the complete credit available to choose from (the fresh new restrict that can be found you to wasn’t utilized). To get an effective score to the borrowing from the bank use costs, you will want to stay lower than 31% 1 of available borrowing (vs what you put) with the anyone cards. This means that if you have a beneficial $ten,000 credit limit, you need to owe below $3,000 on your cards when (= 30% borrowing from the bank use rates). Appear to discuss you to definitely? Increasing your mastercard limit will help optimize your borrowing from the bank utilization.

Charles Mike, a distinguished EV charger expert and author, has over 20 years of experience in electric vehicle charging technology.

Born and raised in Texas, he studied electrical engineering at the University of Texas, where his fascination with EVs began.

His research focuses on improving the efficiency and sustainability of EV chargers, often integrating renewable energy sources. Living in Texas, he continues to advocate for innovative, eco-friendly charging solutions that support sustainable transportation.