What is the factor of your own subprime mortgage crisis?

- Anyone to purchase solution casing: Finance companies and you may credit unions is only going to bring mortgages to have antique house. If you are planning for a tiny domestic, a great houseboat, otherwise a mobile house on leased homes, you will not qualify for home financing from an one financial.

- The brand new Canadians: It requires for you personally to build-up your credit score. Simply because 35% of your own rating is dependant on your credit score. While you are new to Canada and want to buy property, thought providing a subprime home loan.

- Individuals with a personal bankruptcy history otherwise having a customer suggestion: If you have filed to possess bankruptcy proceeding or features undergone a buyers offer, attempt to hold off between step 1 ? and you may 2 yrs to acquire a traditional home loan or CMHC-covered financial of an one lender. You can aquire home financing from a-b financial also contained in this one year pursuing the discharge date.

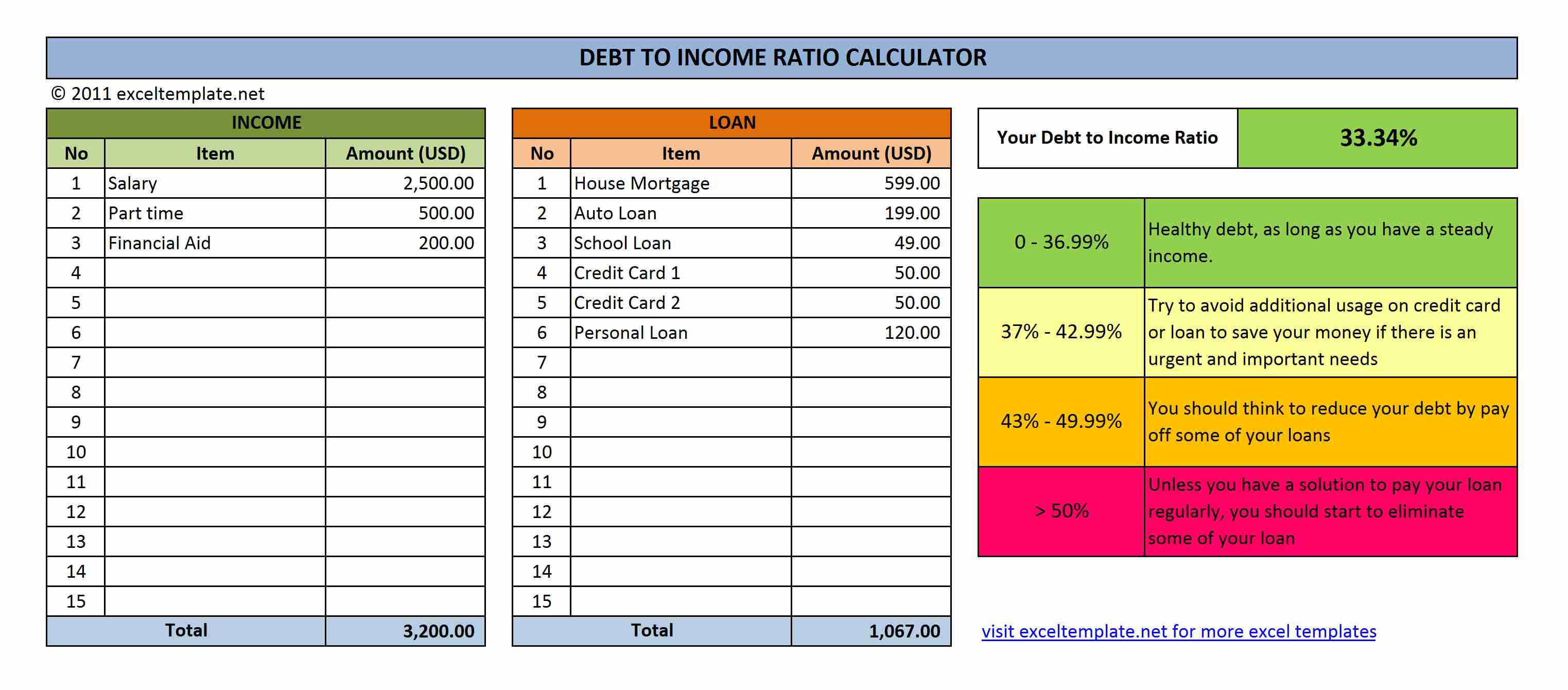

- People with a top Financial obligation-to-Earnings (DTI) Ratio: When you yourself have higher debts, lenders usually shy from you as you may feel extended as well slim to meet up with the month-to-month fees loans. If you want to get a mortgage off an a bank, you either need certainly to decrease your bills otherwise improve earnings.

Whenever a lot of people discover subprime mortgages, it immediately think of the 2008 subprime mortgage crisis one to already been regarding the U.S. and you may wide spread to the rest of the community. It nevertheless renders of several create-end up being beneficiaries timid off providing an excellent subprime home loan.

Subprime mortgage crisis told me

This new subprime home loan drama regarding the U.S. is primarily because of lenders offering mortgages in order to borrowers which you may maybe not afford to make their month-to-month costs. Hedge funds and banks had been making a killing from the bundling these subprime mortgage loans to the MBS (Mortgage-Backed Bonds), which were then insured with Dvds (Borrowing from the bank Default Swaps) and sold so you can buyers. All the mortgages got variable interest levels, starting with reasonable first costs, which may go up in the long run, resulting in a high default rate. The newest incapacity so you’re able to veterinarian borrowers, the newest changeable interest rates, employing MBS sale profits for more borrowers, therefore the high demand having MBSs composed a period bomb. The brand new bomb ultimately burst in the event that construction bubble, described as home prices tumbling and you can property foreclosure growing, been.

Canada was fortunate to flee the brand new drama, mainly because of the a whole lot more stringent home loan rules in the united states. Mortgage LTV (loan-to-value) percentages when you look at the Canada was in fact much lower versus U.S. While the average LTV of new subprime mortgages from the You.S. is actually 100% from inside the 2005, only six% from Canadian mortgages got LTV more than ninety%. Subprime lending when you look at the Canada remains securely regulated, as there are absolutely nothing factor in alarm.

Just how Subprime Mortgages Differ from Best Mortgages

- If you are finest mortgages are supplied from the Chartered banking institutions and you will credit unions which might be federally regulated financial institutions (FRFI), subprime mortgages are supplied from the private creditors that aren’t regulated by the exact same regulatory build.

- Subprime mortgage prices try higher versus finest mortgage pricing just like the of chance subprime mortgage brokers need to use that have smaller creditworthy some body.

- Subprime loan providers convey more everyday rules regarding new credit rating. When you you desire a credit score of at least 680 to qualify for a prime financial, your credit score is not the major attention getting subprime mortgage loans.

- It’s possible to obtain an extended amortization several months (around 40 years) with a subprime financial personal loans online Arkansas.

- Some subprime loan providers require an advance payment from only a small amount as the 10%. You always you would like at the very least an excellent 20% downpayment with many A lenders.

Charles Mike, a distinguished EV charger expert and author, has over 20 years of experience in electric vehicle charging technology.

Born and raised in Texas, he studied electrical engineering at the University of Texas, where his fascination with EVs began.

His research focuses on improving the efficiency and sustainability of EV chargers, often integrating renewable energy sources. Living in Texas, he continues to advocate for innovative, eco-friendly charging solutions that support sustainable transportation.